In this blog, we are going to shed light on the agenda PSD2 Explained: What is it and who does it impact? by answering several important aspects.

The new Second Payment Services Directive PSD2, designed by the countries of the European Union, is a fundamental piece of payment legislation in Europe. PSD2 Explained: What is it and who does it impact?

It comes under effect from 14 September 2019.

It could change the payments industry, affecting everything including from the way customers pay online, to what information customers can see while doing the payment.

The PSD2 aims to increase consumer protection, securing digital identities and improving the security of payment services within the European Union

PSD2 is a European regulation for electronic payment services. It seeks to make payments more secure in Europe, improve innovation and help banking services adapt to new technologies.

pic credit: gemalto.com

Objective of PSD2

- Aims to better payment regulation to reach the current state of the market and technology.

- It introduces security requirements for the initiation and processing of electronic payments, as well as for the protection of consumers’ financial data.

- Make payments safer, increase the consumers’ protection.

- Acknowledge third parties creating new Financial Services through open APIs to customers’ bank accounts.

- Offer dedicated APIs for third party access which results in reducing the risk of the customer’s security and privacy.

Major Changes

Acknowledgement of new players accessing the consumers payment account

New players will not be registered, licensed and regulated at the EU level. With PSD2 regulations this barrier will be removed for these companies.

Moreover, increasing competition reduces the cost for the consumers. In addition, these new players will access the consumer payment accounts.

yodlee.com

Increased security of internet payment using SCA – Stong Customer Authentication

This is one of the most important factors for each bank to provide high security to their customer by evaluating risk and adapting security.

This is very common nowadays banks are prone to cyber-attacks. Fraudsters and hackers are constantly challenging the security measures put in place by banks to protect sensitive business data.

pic credit: gemalto.com

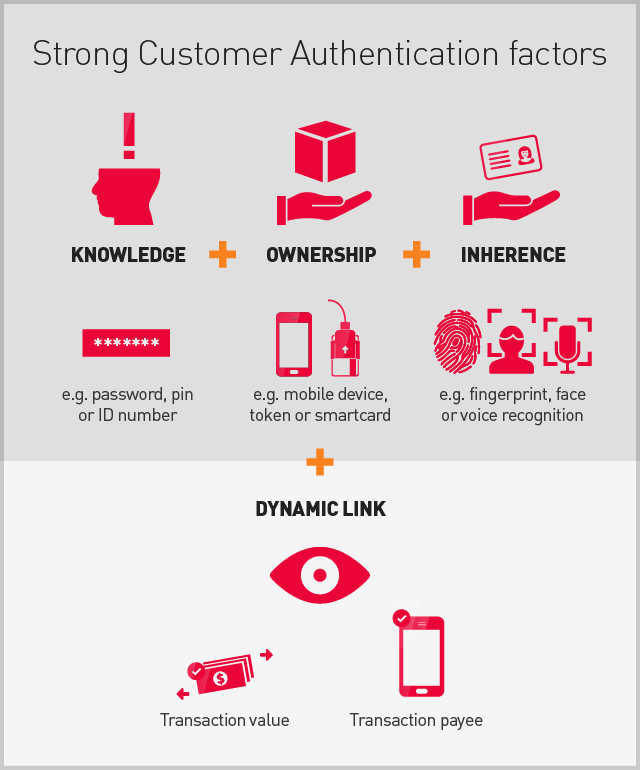

The Second Payment Services Directives apply Strong Customer Authentication as the customer transaction taking place using the following elements:

- Knowledge: only the user knows (e.g. password, pin, ID number)

- Ownership: only the user possesses (e.g. mobile device, smart card)

- Inherence: only the user is (e.g. fingerprint, face or voice recognition)

Improve User Experience

The revised Payment Service Directive PSD2 requires that banks should adopt security measures to reach the level of risk involved.

pic credit: gemalto.com

Impacts of PSD2 on Marketplace Businesses

As per the study, Marketplace is such platforms that are creating new and exciting ways for buyers and sellers. It enables to buy or sell products and services between these two without itself selling any product and services.

In addition, by providing online transactions, marketplace platforms are expending consumer choice, while enabling sellers to scale their business by offering services to the big size of consumers.

A new approach for Marketplaces

The Second Payment Services Directive has introduced many changes that remarkably impact on marketplace businesses in Europe.

By using a licensed payment service provider, marketplace platforms can continue to act on behalf of both parties, as they would not be considered as coming into possession or control of the funds.

As per the new guidelines, marketplaces are likely to use a licensed payment service provider owing to the time and cost of becoming regulated themselves. According to that marketplace platform does not “at any time enter into possession or control of client funds”.

These are managed and settled by the payment service provider.

In the traditional marketplace, the platform acts as an intermediary for both the buyers and the sellers. However, without itself selling the product or service.

Moreover, now the platform can no longer receive payments of buyers to sellers. This is possible when you are holding the payment license from a regulator.

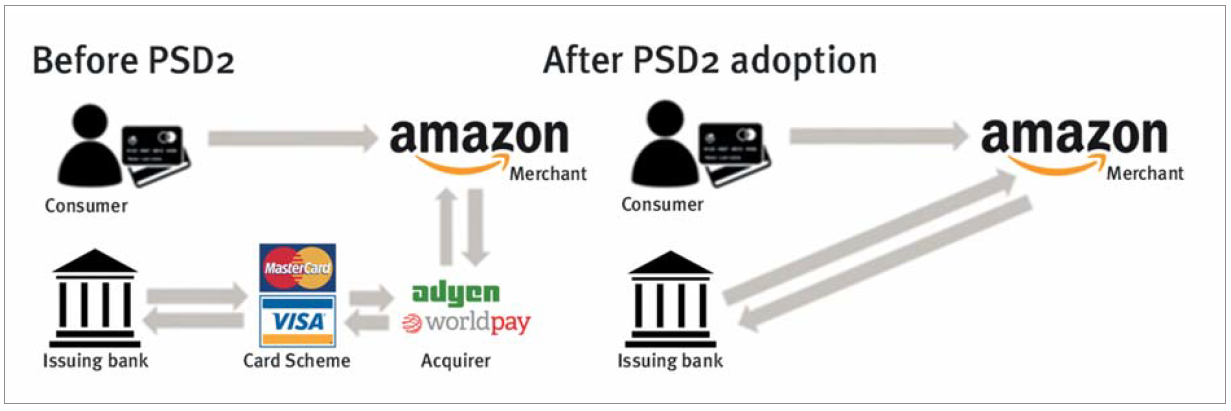

Amazon PSD2 compliance :

zanders.eu

Merchants benefit from the PSD2

Amazon Pay provides a service that allows users an option to pay with their Amazon accounts on the external merchant websites.

Moreover, now Amazon wants to offer merchants a new service. Amazon would need to tap into to merchants’ bank accounts. This will allow Amazon to make an immediate decision whether a particular seller is a legitimate window in which they can lend a certain amount of money.

Amazon benefits from the PSD2

PSD2 enables Amazon to give the seller an outstanding buying power. By which, an ability to provide a lending solution so that they can support their businesses. This is Amazon’s long-term strategy that wants to allow merchants this kind of transactional power without being hit with the risk of the customer not being able to pay for the goods.

Stripe’s payment approach for platforms?

- The stripe created an entirely new product, designing payment flows to ensure that Platforms do not come into possession or control of funds.

- Stripe connects contracts with both the Seller and the Platform to settle payments to the Seller and fees to the Platform.

- The Buyer funds to the Seller are never in the possession or control of the Platform.

- The regulated payment services are rendered by Stripe instead of the Platform, so the Platform does not incur the significant regulatory and compliance overhead of getting a payment license or exemption.

- Stripe Connect offers such marketplaces an alternative Platforms where Stripe Connect do not receive payments owed by buyers to sellers and, instead of having to become a licensed provider of regulated payment services, they can concentrate on growing their marketplace businesses.

- In Europe, Stripe Connect provides marketplace platforms with a sophisticated and compliant payment flow that enables Platforms to design their agreements with their Sellers in compliance with local payment law. That is to say, they can run as a regulated business without pursuing their own payment licenses

Hey guys that all for this blog “PSD2 Explained: What is it and who does it impact?”, I hope this will let you What’s PSD2 and How does it impact Marketplace Platforms.

Till then keep yourself updated with top trending technologies!!!

Stay Connected !!

Be the first to comment.