1. Introduction

The rise of online marketplaces has fundamentally reshaped how goods and services are exchanged in the digital age. From e-commerce giants to niche vertical marketplaces, the ecosystem continues to evolve rapidly.

However, one component remains universally critical across all marketplace models— payments. This Payments in Marketplaces guide aims to provide a comprehensive, expert-level understanding of payments in online marketplaces.

Whether you’re a developer, entrepreneur, business analyst, or platform owner, this resource will help you navigate the complexities of marketplace payment flows, compliance, and technology.

Drawing from real-world practices, regulatory frameworks, and platform architectures, this guide serves as both a foundational and advanced resource.

Importance of Understanding Marketplace Payments

Payments are the lifeblood of any marketplace. A well-structured payment system not only ensures smooth transactions but also builds trust between buyers and sellers, facilitates compliance with financial regulations, and supports sustainable revenue generation.

In an environment where customer expectations for seamless experiences are higher than ever, platforms need to offer secure, transparent, and efficient payment processes. This becomes even more crucial as marketplaces scale globally, deal with cross-border transactions, and manage multi-party payments.

This article will walk you through the essential components of marketplace payments—covering everything from business models to compliance requirements—equipping you with the knowledge to build or refine a robust payment infrastructure.

2. What is a Marketplace?

Definition and Key Characteristics

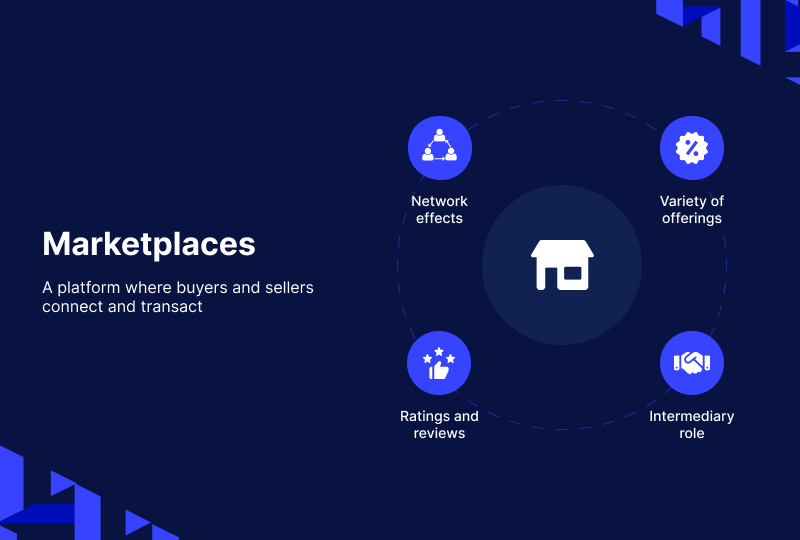

An online marketplace is a digital platform that connects multiple buyers and sellers, facilitating the exchange of goods or services. Unlike traditional eCommerce stores, where a single vendor sells directly to customers, marketplaces allow third-party vendors to list and sell their offerings through a shared infrastructure.

Key characteristics of a marketplace include:

- Multi-vendor ecosystem: Sellers manage their own inventory and pricing.

- Centralized buyer experience: Customers interact with a unified interface.

- Platform-mediated payments: The platform handles transactions, disburses payouts, and often provides dispute resolution.

- Scalability: Marketplaces are inherently scalable, offering a broader product or service range without holding inventory.

Evolution of Online Marketplaces

The marketplace model has evolved significantly over the past two decades. Starting with eBay’s pioneering peer-to-peer auctions in the 1990s, the online marketplace concept has evolved considerably.

Today, major platforms like Amazon, Alibaba, and Etsy dominate, facilitating a wide range of business and consumer interactions, including B2C, B2B, C2C, and P2P models.

According to Statista, global marketplace sales accounted for over $3.25 trillion USD in 2023, representing more than 67% of global eCommerce transactions.

This growth is fueled by increased internet access, mobile adoption, and changing consumer behavior towards platform-based purchasing (Statista, 2024).

Modern marketplaces have diversified into sectors such as:

- Product-based platforms (e.g., Amazon, AliExpress)

- Wholesale/B2B platforms (e.g., Alibaba)

- Service-based platforms (e.g., Upwork, Fiverr)

- Rental marketplaces (e.g., Airbnb, Turo)

- Digital goods platforms (e.g., Envato, Gumroad)

“A marketplace platform is not just a catalog of vendors—it’s an ecosystem that thrives on seamless interactions, robust backend systems, and frictionless payments.”

3. Marketplace Business and Revenue Models

Understanding the business and revenue models behind marketplaces is crucial for building a sustainable and profitable platform. Each model affects how payments are handled, how vendors are onboarded, and how trust is maintained between all parties.

3.1 Commission-Based Model

The commission-based model is the most common in marketplace ecosystems. Here, the platform charges a percentage of each transaction made through the site. This model aligns with performance and scales easily as the number of transactions grows.

Example: Amazon, Airbnb, and Etsy charge commissions on every sale made by vendors or hosts.

According to a report by Juniper Research, global platform commission revenue is expected to exceed $500 billion by 2025, driven largely by marketplaces (Juniper Research, 2023).

3.2 Subscription or Membership-Based Model

In this model, sellers or buyers (or both) pay a recurring fee to access the platform or premium features. It ensures consistent revenue regardless of transaction volume.

Example: LinkedIn Premium for service providers or Amazon’s Seller Central Professional plan. This model works well in B2B or niche service marketplaces, where access to a curated audience or specialized tools justifies the subscription cost.

3.3 Listing Fee Model

Marketplaces may charge a fee to list products or services, regardless of whether a transaction takes place. This model is often used by platforms with high visibility or specialized audiences.

Example: Etsy charges a nominal listing fee per item, which is separate from its transaction commission. This model can be combined with commissions to offset platform operating costs, especially in lower-volume niches.

3.4 Freemium Model

The freemium model offers basic services for free while charging for advanced features like better listing visibility, analytics, or priority support.

Example: Fiverr offers basic listings for free but provides premium seller services through subscriptions like “Seller Plus.” This model encourages onboarding of new vendors while allowing the platform to monetize power users.

3.5 Lead Fee Model

Instead of charging for transactions, the platform earns by charging vendors for access to potential leads. This is common in services marketplaces where deals are closed off-platform. Example: Thumbtack and Bark charge professionals for each lead or inquiry they receive.

3.6 Hybrid Revenue Models

Many modern marketplaces adopt a hybrid model, combining commissions, subscriptions, listing fees, and freemium features. This creates multiple revenue streams and provides flexibility across different types of sellers.

Example: Alibaba uses a combination of membership plans (for supplier visibility), advertising, and transaction-based fees for different segments.

4. Role of Payments in a Marketplace

Why Payments Are Core to Marketplace Success

Payments are not just a backend function—they are the strategic backbone of a marketplace. A seamless, secure, and well-integrated payment system directly impacts user experience, platform trust, vendor satisfaction, and overall business viability.

A McKinsey report on global payments highlighted that digital payments accounted for 72% of all global eCommerce transactions, underscoring the critical role of robust payment infrastructure in digital commerce.

Marketplaces that neglect payment optimization often face:

- Cart abandonment

- Vendor churn due to delayed payouts

- Compliance liabilities

- High dispute and refund rates

Conversely, platforms with frictionless payment systems build long-term user retention and strong revenue flows.

Payment Experience and User Trust

Trust is a currency in marketplaces—and payment experiences often determine how trustworthy a platform feels. Users expect:

- Multiple secure payment options

- Clear refund and dispute policies

- Instant or timely confirmations

- Transparent pricing and fees

A survey by Baymard Institute found that 18% of users abandon carts due to a “too long/complicated checkout process,” while 17% cite concerns over payment security (Baymard, 2024). Integrating intuitive, mobile-friendly, and secure payment workflows is vital for trust and conversion rates—especially in cross-border or high-value transactions.

Revenue Collection and Distribution

For marketplace operators, payment infrastructure isn’t just about collecting money—it’s also about disbursing it fairly and compliantly. This includes:

- Split payments: Dividing funds between vendors, affiliates, and the platform.

- Delayed payouts: Holding funds in escrow until services/products are confirmed.

- Fee deduction: Extracting commissions or service charges before distribution.

- Cross-border settlements: Handling multi-currency payouts and foreign exchange conversions.

Ensuring the right logic is applied at every touchpoint—from checkout to payout—helps streamline accounting, avoid manual errors, and maintain vendor trust.

“Payments are not just a feature in a marketplace—they are the infrastructure on which user confidence and operational integrity are built.”

5. Types of Marketplaces and Their Payment Flows

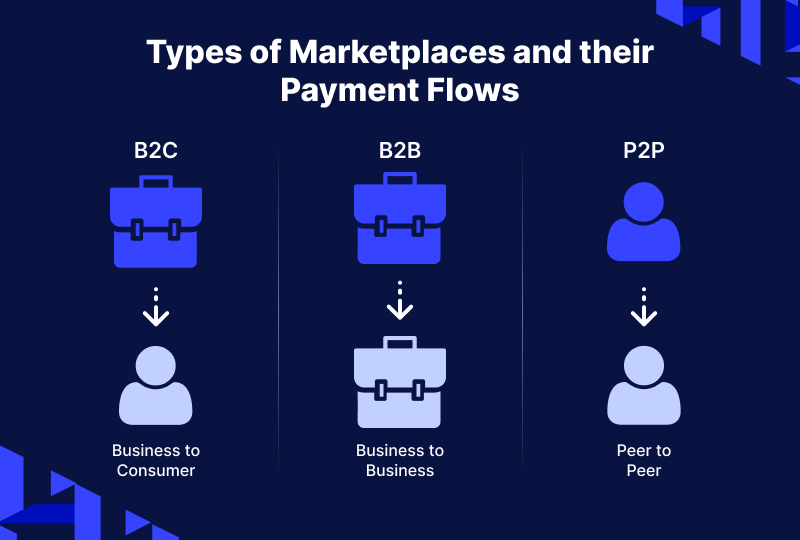

Marketplace payment needs can vary significantly based on the business model. Whether it’s a peer-to-peer exchange or a complex B2B transaction, each type of marketplace requires a tailored payment flow to ensure compliance, trust, and efficiency.

5.1 Consumer-to-Consumer (C2C)

- Typical Payment Flow: In C2C marketplaces, individuals sell directly to other individuals. The platform typically acts as a facilitator for listing, payment processing, and dispute resolution. Example: eBay, OLX, Facebook Marketplace.

- Standard payment flow:

- Buyer initiates payment via integrated payment gateway.

- Platform may hold funds (escrow) until delivery is confirmed.

- Funds are released to the seller.

- Standard payment flow:

- Challenges and Considerations:

- Fraud prevention is critical, as trust between parties is low.

- Requires a strong dispute resolution and refund mechanism.

- Platforms must manage KYC (Know Your Customer) for both parties to mitigate risk.

5.2 Business-to-Consumer (B2C)

- Payment Flow and Compliance: In B2C marketplaces, businesses sell products or services to individual consumers. Payment flows are more straightforward but must handle tax compliance, refund policies, and real-time transaction verification. Example: AliExpress, Wayfair, Zalando.

- Key features:

- Payment gateways handle real-time authorization and settlement.

- Platforms may deduct commission before vendor payout.

- Integration with invoicing and tax systems is often required.

- Key features:

- Considerations:

- PCI DSS compliance is mandatory for platforms handling card data.

- Ensuring multi-currency support for global audiences is a common requirement.

5.3 Business-to-Business (B2B)

- Payment Terms, Invoicing, and Delayed Payments: B2B marketplaces support transactions between wholesalers, manufacturers, or service providers. These transactions are often high-value and complex. Example: Alibaba, ThomasNet.

- B2B marketplaces support:

- Invoicing with net payment terms (e.g., Net 30, Net 60)

- Bank transfers, escrow, and credit arrangements

- Milestone-based or contractual payments

- B2B marketplaces support:

- Challenges:

- Managing delayed payments and credit risk

- Handling tax regulations, including VAT and GST

- Need for customizable invoicing systems

- A report from Deloitte notes that B2B marketplaces are growing rapidly, with 80% of B2B buyers expecting similar digital experiences to those of B2C platforms.

5.4 Peer-to-Peer (P2P)

- Escrow and Trust Mechanisms: Though similar to C2C, P2P marketplaces often focus on sharing economy models like rentals or service exchanges. Example: Airbnb, Turo, BlaBlaCar.

- Key payment characteristics:

- Use of escrow systems to hold funds during service periods

- Payouts are time-locked or conditionally released

- Dispute and arbitration mechanisms are essential

- Key payment characteristics:

- Considerations:

- Requires robust identity verification and sometimes background checks

- Handling insurance or security deposits can complicate payment processing

- A Trustpilot consumer report shows that 73% of users consider secure payments the most important trust factor in P2P marketplaces.

6. Common Payment Models Used in Marketplaces

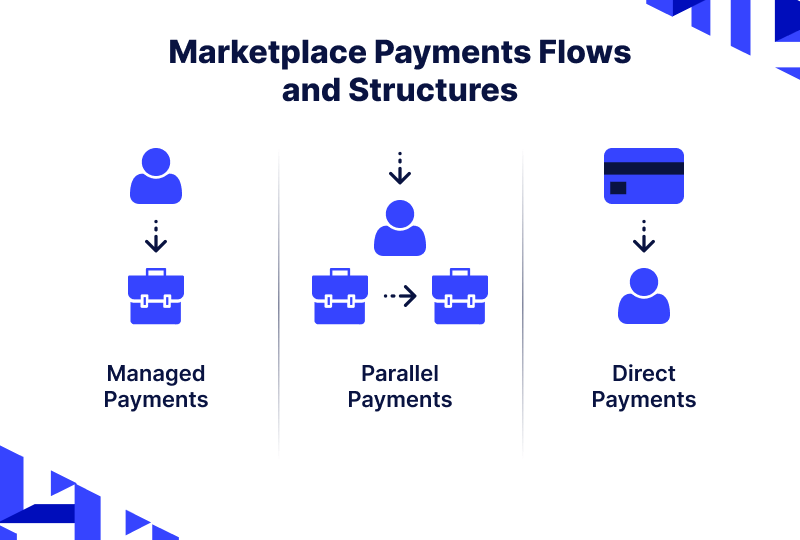

The structure of payments in a marketplace is not just about collecting money—it governs how funds are split, when they are disbursed, and how stakeholders interact financially. A well-defined flow ensures compliance, transparency, and operational efficiency.

6.1 Real-Time Split Payments

Real-time split payments automatically divide the payment among the seller, the platform (for commission), and any third parties at the time of transaction. This eliminates the need for manual settlements and improves cash flow for vendors. Example: Stripe Connect, Adyen MarketPay. Benefits:

- Instant payout for sellers

- Automatic commission handling

- Reduced operational overhead Consideration:

- Requires a payment provider that supports marketplace-specific APIs

- May trigger licensing requirements in some jurisdictions (e.g., EU’s PSD2).

6.2 Delayed/On-Hold Payments (Escrow Model)

The escrow model holds funds after purchase until a condition is met (e.g., delivery confirmation). This is common in service-based and high-risk product marketplaces. Example: Airbnb (release after stay), Upwork (milestone-based). Benefits:

- Builds trust between buyer and seller

- Supports phased payments or milestone triggers Challenges:

- Requires regulatory approval in some countries

- Adds complexity in refund/dispute workflows According to the Harvard Business Review, escrow-based systems significantly increase trust in first-time P2P transactions, reducing fraud-related complaints by over 40% (HBR, 2023).

6.3 Aggregated Payments and Payouts

In this model, the platform collects payments from multiple buyers and pays out to sellers in bulk, either periodically or upon request. Use Case: Marketplaces with many microtransactions or subscription-style purchases (e.g., Patreon, Gumroad). Advantages:

- Streamlines accounting and reconciliation

- Ideal for platforms with high transaction volume but low individual value Risks:

- Holding funds may trigger the need for a payment institution license

- Greater responsibility for fraud detection and tax compliance.

6.4 Multi-party Payment Distribution Models

Some marketplaces involve more than just buyers and sellers—think affiliates, logistics providers, or software partners. Payments must be split across these parties with traceable, rule-based automation. Example: Amazon (involving sellers, shippers, and affiliate marketers). Key Considerations:

- Needs highly flexible logic

- Increases demand for transactional transparency

- Must integrate with multiple payment services or wallets This complexity is often handled through modular financial orchestration platforms or advanced payment APIs like those provided by PayPal for Marketplaces and MangoPay.

6.5 Refunds, Disputes, and Chargebacks

No payment system is complete without a process for handling refunds, disputes, and chargebacks. These elements directly impact platform credibility and financial health. Best Practices:

- Clear refund and return policies visible during checkout

- Automated refund triggers for cancelled or undelivered items

- Transparent chargeback handling workflows According to Visa, chargeback fraud (friendly fraud) causes over $30 billion in global losses annually, much of which affects marketplace sellers who lack proper dispute support (Visa, 2023).

Marketplace operators must carefully choose their payment structure based on the nature of their ecosystem, target audience, regulatory obligations, and technical capabilities. A misaligned flow can result in financial loss, legal exposure, and reputational damage.

7. Payment Regulations for Marketplaces

Navigating the regulatory landscape is one of the most challenging aspects of building and scaling a marketplace. Since marketplaces often facilitate financial transactions on behalf of third parties (sellers or service providers), they may fall under financial regulation depending on the jurisdiction and payment model. Failing to comply can result in hefty fines, legal action, and platform bans. Here are the key regulatory domains that marketplace operators need to understand.

7.1 KYC (Know Your Customer)

KYC regulations require platforms to verify the identity of sellers (and in some cases buyers) to prevent fraud, money laundering, and terrorism financing. Key KYC steps:

- Collect legal documents (government-issued ID, tax ID)

- Use third-party KYC services (e.g., Jumio, Onfido)

- Maintain ongoing monitoring of suspicious activity. KYC requirements become mandatory if the marketplace controls or holds funds on behalf of others, which may categorize it as a payment facilitator under financial laws.

7.2 AML (Anti-Money Laundering)

AML frameworks are designed to detect and report suspicious transactions. Marketplaces must:

- Monitor for unusual payment patterns

- Flag high-risk countries or users

- Report large or structured transactions to financial authorities. Many modern marketplaces use automated AML screening tools that work alongside KYC platforms for seamless compliance. Reference: The FATF (Financial Action Task Force) provides guidance on AML practices for digital platforms (FATF, 2023).

7.3 PCI DSS Compliance

Any platform handling credit or debit card information must comply with PCI DSS (Payment Card Industry Data Security Standard). This includes:

- Tokenizing card data

- Encrypting payment information

- Performing regular security audits. Platforms not fully PCI-compliant must either outsource payment processing to a PCI-certified gateway (like Stripe, Braintree) or face heavy penalties. PCI DSS Version 4.0, effective from 2024, has introduced more stringent requirements for third-party service providers (PCI Security Standards Council).

7.4 PSD2 and SCA (for EU)

PSD2 (Payment Services Directive 2) is a European regulation that governs electronic payments. A critical component is Strong Customer Authentication (SCA), which mandates multi-factor authentication for most online transactions. Marketplace Impact:

- Must support 3D Secure 2.0 or biometric validation

- High friction can reduce conversion if not implemented properly Note: Exemptions exist for low-value or recurring transactions.

7.5 Licensing and Registration as a Payment Facilitator or Institution

Depending on the flow of funds, a marketplace may be required to register as:

- Payment Facilitator (PayFac)

- Money Services Business (MSB) in the U.S.

- Electronic Money Institution (EMI) in the EU For example: A platform using aggregated payment models (holding and distributing funds) may need an EMI license under EU regulations or MSB registration under FinCEN in the U.S.. Acquiring such licenses involves:

- Capital requirements

- Risk management frameworks

- Reporting obligations

- Ongoing audits.

7.6 Handling Buyer and Seller Identity Verification

Regulatory compliance also demands the ability to:

- Verify sellers for payout eligibility

- Prevent duplicate or fraudulent buyer accounts

- Maintain an audit trail of all identity checks. This is particularly important in high-risk verticals such as cryptocurrency, adult content, or luxury goods marketplaces.

7.7 Role of Third-Party Payment Processors in Compliance

To reduce regulatory burden, many marketplaces partner with regulated payment providers (e.g., Stripe Connect, Adyen, PayPal for Marketplaces). These processors offer:

- Built-in KYC/AML workflows

- Regulatory coverage across multiple regions

- PCI DSS compliance out of the box. This model is ideal for startups and mid-sized platforms that want to launch quickly while staying compliant.

Marketplace founders and operators must treat payments and compliance as core strategic priorities, not afterthoughts. Regulatory expectations are increasing globally, and marketplaces that proactively implement frameworks for identity, security, and transparency are best positioned for long-term trust and growth.

8. Security in Marketplace Payments

Security is not just a technical requirement in marketplace payments—it’s a fundamental pillar of user trust. With increasing sophistication in fraud tactics and growing consumer expectations for safety, marketplaces must prioritize payment security from day one.

Why Payment Security Matters

A single data breach or fraudulent transaction can result in:

- Financial loss for users and the platform

- Regulatory fines (especially under laws like GDPR, CCPA)

- Reputation damage, which can take years to recover. According to IBM’s 2023 Cost of a Data Breach Report, the average cost of a breach in eCommerce was $4.45 million, and marketplaces with weak fraud detection systems were 27% more likely to suffer repeat breaches (IBM, 2023).

Common Threats to Payment Security

- Card Testing Attacks: Bots test stolen card numbers on marketplaces.

- Account Takeover (ATO): Hackers gain access to buyer/seller accounts to initiate unauthorized transactions.

- Phishing and Social Engineering: Users tricked into sharing login or payment info.

- Friendly Fraud: Buyers make legitimate purchases, then issue chargebacks dishonestly.

Security Best Practices for Marketplaces

To protect buyers, sellers, and the platform itself, marketplaces should adopt a multi-layered approach to payment security:

- End-to-End Encryption: Ensure all payment and personal data is encrypted in transit and at rest using TLS 1.2+ and AES-256 standards.

- Tokenization: Replace sensitive card details with secure, non-reversible tokens. This reduces the risk of data leaks and lowers PCI DSS scope.

- Strong Authentication: Implement MFA (Multi-Factor Authentication) for both buyers and sellers, particularly during logins and withdrawals.

- Real-Time Fraud Detection: Use machine learning-based fraud detection tools (e.g., Sift, Riskified, Forter) to monitor suspicious login patterns, transaction velocity, Geo/IP mismatches.

- Transactional Alerts: Notify users in real-time of account activity like password changes, payment attempts, or new device logins.

- Secure Refund and Dispute Workflows: Hold transaction logs securely, provide traceable communication between buyers and sellers, and use automated tools to detect repeat abusers of refund systems.

Leveraging Secure Payment Providers

Partnering with reputable PCI DSS Level 1-compliant gateways like Stripe, PayPal, or Adyen can offload much of the security infrastructure. These providers:

- Tokenize payment data by default

- Offer integrated fraud detection

- Stay up-to-date with evolving compliance standards.

“Security is not just a feature—it is the foundation of trust that marketplaces are built upon.” — World Economic Forum, Digital Trust Framework (2022)

As fraudsters evolve, so must marketplaces. Investing in security upfront is far more cost-effective than reacting to breaches or chargebacks after damage is done. User safety and data integrity should be treated as competitive advantages, not just obligations.

9. How to Choose the Right Marketplace Payment Gateway?

A well-chosen payment provider is the backbone of a successful marketplace. Beyond enabling transactions, payment gateways offer critical services like KYC compliance, fraud prevention, currency conversion, tax handling, and even dispute resolution. For marketplaces, the challenge isn’t just accepting payments—it’s managing a complex network of pay-ins, pay-outs, and payment splits across multiple stakeholders, often in multiple countries.

Key Capabilities to Look for

When choosing a payment provider, marketplace operators should look for features such as:

- Split Payments: Ability to divide payments automatically between the platform, sellers, affiliates, etc.

- Seller Onboarding: Integrated tools to collect and verify seller information (e.g., identity, tax IDs)

- Global Currency Support: Multi-currency transactions and localized payment options

- Tax and Compliance Management: Help with VAT, GST, 1099-K, and other jurisdiction-specific requirements

- Dispute Handling: Tools for managing chargebacks and buyer-seller disputes

- Payout Flexibility: Scheduled, on-demand, or milestone-based payouts to sellers

Leading Payment Providers for Marketplaces

Here are some of the most popular and capable providers supporting complex marketplace payment workflows:

- Stripe Connect: One of the most developer-friendly options, supporting real-time split payments, automated seller onboarding, and extensive global compliance coverage. Used by platforms like Kickstarter, Shopify, and Instacart.

- PayPal for Marketplaces: Allows handling parallel/chained payments, seller onboarding via PayPal accounts, and offers PayPal Credit/Buyer Protection. Trusted by Upwork and eBay.

- Adyen MarketPay: Built for larger international marketplaces, offering advanced risk/compliance tools, multi-party splits, and unified commerce. Used by Booking.com, Etsy, and GOAT.

- MangoPay: Tailored for marketplaces/crowdfunding, offering escrow, multi-currency wallets, and full KYC/AML support. Popular in Europe (Vinted, KissKissBankBank).

- Checkout.com: A newer player with strong support for modular API-first workflows, ML-powered fraud prevention, and global payment methods.

When to Use Custom vs. Pre-Built Gateways

| Situation | Use a Pre-Built Gateway | Build Custom Solution |

| Startups with limited engineering | ✅ Yes | ❌ No |

| Need for global regulatory coverage | ✅ Yes | ❌ No |

| Highly unique commission logic | ⚠ Maybe | ✅ Yes (if well-resourced) |

| Operating in high-risk verticals | ✅ (with risk-focused gateway) | ✅ Yes (with in-house controls) |

Export to Sheets

How Bagisto Supports Payment Integration

Although Bagisto has been mentioned earlier, it’s worth noting that it supports a wide range of third-party payment gateways, including Stripe, PayPal, Razorpay, and others. Its extensible architecture enables marketplace owners to add custom payment logic, making it suitable for diverse regional and business-specific needs. This flexibility is particularly useful for startups and SMEs building localized or niche marketplaces that require integration with local payment gateways or alternative payment methods (APMs).

Selecting the right payment provider is not just a technical decision—it’s a strategic move that affects seller onboarding, user trust, regulatory compliance, and ultimately, platform scalability.

10. Key Challenges and Considerations in Marketplace Payments

While payments can be a powerful growth enabler, managing them in a marketplace ecosystem introduces a unique set of challenges that traditional eCommerce does not face. These complexities stem from the multi-party nature of transactions, cross-border operations, regulatory burdens, and diverse buyer-seller expectations.

- Managing Split Payments and Commissions: Marketplaces often need to split a single payment between multiple parties. Without automation, this can become a compliance and operational nightmare. Many platforms use Stripe Connect, Adyen, or MangoPay to automate this.

- Ensuring Global Compliance: Expanding marketplaces face varying regulatory obligations like local taxes (VAT/GST), KYC/AML, and licensing (EMI/MSB).

- Handling Refunds, Disputes, and Chargebacks: This is especially difficult in C2C/P2P models where the platform may bear liability. Challenges include chargeback abuse and ambiguous policies. Clear policies and automated tools are essential.

- Delayed Payouts and Seller Trust: Holding funds protects buyers but delayed payouts can erode seller trust. Balancing buyer protection and seller friction is key, often managed via escrow or milestone payments.

- Fraud Detection and Risk Management: Marketplaces must actively monitor for fraud using tools that analyze payment velocity, device fingerprinting, and user behavior. Tools like Sift, Signifyd, and Riskified use AI for real-time prevention.

- High Payment Failure Rates in Emerging Markets: Low card penetration requires supporting Alternative Payment Methods (APMs) like UPI, M-Pesa, or BNPL options. Choose gateways with localized options.

- Taxation and Withholding Requirements: Marketplaces may need to withhold taxes, report earnings (e.g., 1099-K), and register for VAT globally.

- User Experience vs. Compliance: Strict compliance (complex KYC/SCA) can hurt user experience and lead to abandonment. Use progressive verification for a smoother flow.

Marketplace payments sit at the intersection of technology, regulation, finance, and experience. Solving these challenges requires payment infrastructure that is scalable, secure, compliant, and user-first. Platforms achieving this gain loyalty and credibility.

11. Future Trends in Marketplace Payments

The world of marketplace payments is evolving rapidly. Staying ahead of technological, behavioral, and regulatory shifts is critical for competitiveness, scalability, and compliance.

- Embedded Finance and Banking-as-a-Service (BaaS): Marketplaces are becoming financial platforms, offering branded cards, wallets, early payouts, and working capital loans. Example: Amazon Lending, Shopify Capital (issued >$5B by 2023).

- Rise of Alternative Payment Methods (APMs): Beyond cards, users prefer digital wallets (50% of global eCommerce payments), BNPL (>$450B volume by 2026), QR codes, and crypto. Integrating APMs boosts conversion and regional reach. (Source: Worldpay 2024 Report).

- AI-Powered Fraud Prevention: Next-gen AI tools flag anomalies, detect synthetic identities, and assess risk in real-time. Providers like Sardine, Persona, and Sift lead in AI-first fraud management for platforms.

- Faster Payouts via Real-Time Rails: Sellers expect instant access to funds via systems like FedNow (USA), SEPA Instant (EU), UPI (India). Payout windows are shifting from days to seconds. “Instant payouts are not a feature anymore—they’re an expectation.” — PYMNTS.com, 2024.

- Decentralized and Tokenized Payments: Blockchain solutions (e.g., stablecoins like USDC) are explored for lower cross-border fees, smart contract escrow, and digital ID verification, especially in NFT/freelance markets.

- RegTech Integration for Real-Time Compliance: Marketplaces use Regulatory Technology (RegTech) to automate eKYC, AML screening, and tax reporting. Tools like ComplyAdvantage, Jumio, TaxJar make compliance scalable.

- Platform-Owned Payment Infrastructure: Mature marketplaces may build in-house payment solutions for cost savings and control. 🛠 Example: Etsy acquired Adyen to build its stack.

- Sustainable and Ethical Payments: Growing ESG focus leads to carbon-offset payments, donation prompts, and transparent payout policies, attracting ethically minded consumers.

The future of payments is about speed, security, ownership, inclusivity, transparency, and adaptive intelligence. Embracing these shifts builds resilient, scalable, and user-centric ecosystems.

12. Conclusion

Marketplace payments are the financial and trust engine powering the platform. Ensuring seamless interactions, navigating regulations, and enabling fast payouts is foundational and strategic.

This guide covered:

- Marketplace evolution and revenue models

- Payment flows (C2C, B2C, B2B)

- Split payments, escrow, and regulations

- Security, fraud, and compliance complexities

- Future trends from embedded finance to AI.

Success depends on the robustness, transparency, and efficiency of your financial infrastructure.

Final Word: Choosing the Right Foundation

Whether building a niche marketplace or scaling globally, your payment infrastructure must align with your vision. Bagisto, an open-source Laravel-based eCommerce framework, provides the flexibility to integrate with popular payment providers and customize workflows. Its modular structure suits businesses aiming for speed-to-market and scalability.

Investing in the right tools and strategies turns complex payments into a competitive advantage—fostering trust, driving revenue, and delivering exceptional user experience.

Be the first to comment.